Chapter 7 Bankruptcy Attorneys

Lawyers for Declaring Chapter 7 Bankruptcy in Arizona

Chapter 7 bankruptcy is the type of bankruptcy that virtually wipes the slate clean of unsecured debt including: (credit cards, medical debt, non-secured personal loans and lines of credit, amounts owed on leases, amounts owed after vehicle repossessions and more). As a result, an individual or couple must qualify for chapter seven to get chapter 7 relief. Thus, our bankruptcy attorneys in Tempe, Phoenix, and Mesa are experienced professionals who will determine, not only if you are a candidate for chapter 7 debt relief, but also, given your current state of affairs, how it would effect you.

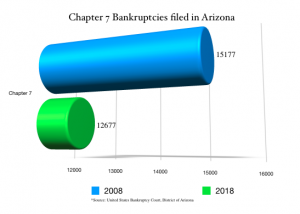

Therefore, you are not asked to make payments in a chapter 7 bankruptcy. Instead, your debts are completely alleviated and wiped away when you file bankruptcy in Maricopa County, Arizona. As such, in your Arizona chapter 7 bankruptcy, you are able to hang on to much of your property. These are some of the many reasons that chapter 7 bankruptcy is the most used chapter of bankruptcy in Tempe and throughout Arizona.

Chapter 7 Bankruptcy Exemptions

In addition, the ability to keep your possessions in a bankruptcy is called an exemption and in this case, an exemption is a good thing. For one thing, exemptions are made for various types of items that you need for your survival, like food, housing, clothing, transportation etc. However, it does vary case to case.

In addition, the ability to keep your possessions in a bankruptcy is called an exemption and in this case, an exemption is a good thing. For one thing, exemptions are made for various types of items that you need for your survival, like food, housing, clothing, transportation etc. However, it does vary case to case.

For example, when you file for Ch 7 bankruptcy, exemptions in Arizona are a little different than in other states. At Chapter Bankruptcy Law, our Arizona Chapter 7 lawyers will help you identify exempt property within the current Arizona bankruptcy laws. These chapter 7 bankruptcy exemptions are information that is important. For instance, Arizona bankruptcy law does not allow you to choose exemptions allowed under federal bankruptcy laws.

Therefore, bankruptcy exemptions in a ch 7 is definitely something that you should explore. In fact, your Henderson bankruptcy attorney can explain to you in detail what things you are able to keep and what things may have to go when considering declaring bankruptcy. In any case, our experienced debt relief expert knows how to make the most of your bankruptcy exemptions.

Typically, a chapter 7 bankruptcy filing in Mesa or Tempe takes on average about 5 to 7 months. For this reason, every Arizona bankruptcy case is unique. For example, some complete faster, while in some cases it may take longer. Either way, our Henderson bankruptcy attorney will be with you every step of the way as you file for bankruptcy protection. Specifically, Chapter Bankruptcy Law takes pride in it’s customer service. As always, your representation every step of the way is important to our Arizona bankruptcy attorneys and staff.

What are the differences between a No Asset Ch 7 and an Asset Chapter 7?

A No Asset Chapter 7 case means that the trustee has abandoned all assets and will not be taking any of your assets to sell to pay creditors. Thus, an Asset Chapter 7 case means that the trustee is holding open the case so that he/she may sell some of your assets. In this case, the trustee will usually set up an auction to sell your property. Remember: The trustee can only sell something over the exemption amount. Some of your assets are protected by the aforementioned exemptions.

- Child Support Payments

- Certain Types of Taxes

- Most Student Loans

- Fraudulent Debts

- Debts for willful and malicious injury

- Alimony or spousal support

We are a debt relief agency. We help people in Arizona file for bankruptcy relief under the Bankruptcy Code.

BEGIN FILING FOR $0 DOWN

•

Getting a fresh financial start and wiping out debt begins with a FREE CONSULTATION and debt evaluation with our experienced Arizona Bankruptcy attorney. As a result, Chapter Bankruptcy Lawyers offers expert legal representation and $0 down to file your bankruptcy.

• Chapter 7 Bankruptcy • Chapter 13 Bankruptcy • Eliminate Debt with $0 Down • Free Debt Evaluation • Experienced, Trusted Attorney

In addition, after evaluating your debt, our attorney will recommend the best means by which to wipe out your debt. Next, upon qualifying for our program, you pay $0 down for legal fees. A payment arrangement is agreed upon in order to make low monthly payments for post-filing costs. Lastly, contact our low cost Mesa and Tempe bankruptcy attorneys today.

GET STARTED

get IN TOUCH

with an experienced Arizona bankruptcy attorney

480.485.1010

find OUR OFFICE

4500 S Lakeshore Drive Suite 300 Tempe, AZ 85282